Hercules PLC's 4 Strategies to Successfully Manage Change at Scale

From Strength to Strength: The Hercules PLC Story

In just 15 years, Hercules PLC has gone from start-up to going public, listed on the London AIM market, and becoming a heavy-weight player in the UK labour supply sector.

Impressive, given that the construction labour supply industry is saturated. Yet, Hercules PLC stands out.

What’s their secret?

Their competitive edge is agility.

Using sophisticated software solutions, Hercules stays ahead of the competition by providing quick labour supply to large-scale projects like HS2.

Their strategy works, and they’re growing. Fast. Between 2023 and 2024, their annual revenue grew by 28% to £102 million, and they’re not stopping there.

Hercules is acquiring companies at pace. In 2025 alone, they acquired three companies, and by 2029, they aim to grow their revenue to c£400m – £500m

But with unprecedented growth comes significant challenges.

The Challenges of Rapid Growth for a Digital Team

During this unprecedented growth, the Digital and Technology team at Hercules PLC faced a number of challenges:

Reactive, ad hoc decisions: Effective for the short-term, but for their long-term plans, a more consistent and controlled approach to change was crucial.

Growing complexity of processes and technology: Onboarding new acquisitions and contractors is complex, affecting recruitment and payroll processes. Hercules needed visibility into how this all integrates, to keep services running smoothly.

Risk of uncoordinated change across the business: To execute on their ambitious growth plans, the entire business needs to be on the same page. Without a single source of truth to describe the impact of change, communication becomes difficult, hindering execution.

Hercules PLC’s 4 Strategies to Effectively Manage Digital Transformation Through Growth

How does Hercules integrate new companies and workers while seamlessly delivering services?

Here are 4 strategies they leverage to manage digital transformation:

- Gain visibility, and reduce complexity to ensure uninterrupted services

- Stay focused, and prioritise quick service delivery.

- Planning for long-term success with a single source of truth.

- Communicating change across teams

1. Gain visibility, and reduce complexity to ensure uninterrupted services

“We run a large business with a large payroll,” says Ed Horner, Head of Digital and Technology, “We can’t afford to make mistakes.”

Each acquired company has its own recruitment processes, pay rates for workers, and systems that complicates existing processes for the team.

By leveraging Enterprise Insight’s process and capability modelling, the digital team can rest assured that they’re aware of any risks that may affect service delivery.

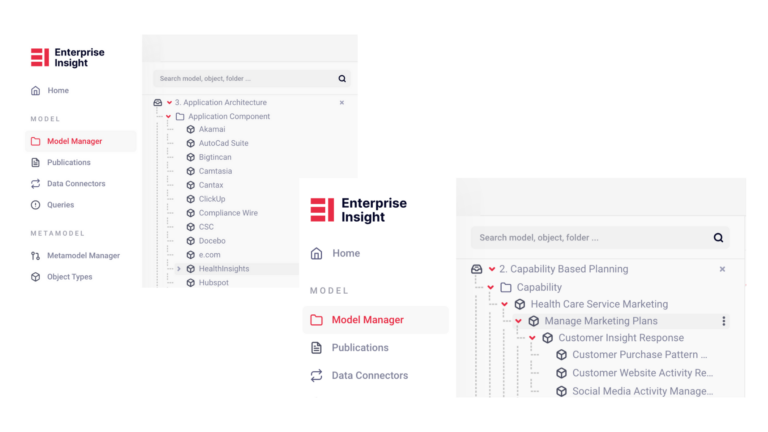

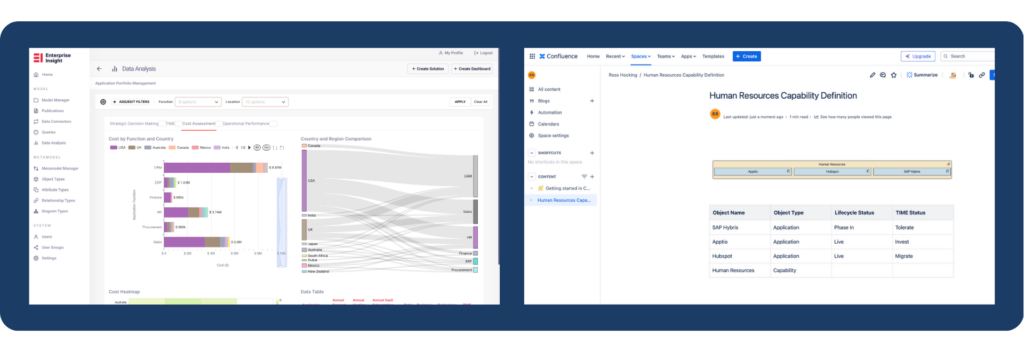

Understanding how their processes, services and technology are linked creates space for efficient labour onboarding. Get a sneak peak into Enterprise Insight’s view generator.

2. Stay focused, and prioritise quick service delivery.

Agility is one stand-out element of Hercules in the industry. With a sophisticated recruitment app, construction workers are quickly onboarded, and paid for their work accurately, reliably and on-time.

As the company grows, it’s imperative that Hercules maintain their pioneering reputation for quick recruitment. This agile-focused philosophy bleeds into their day-to-day operations. How? They focus relentlessly on the tasks that matter most.

Spending weeks and months on prolonged implementations of new technologies, data migrations, and convoluted modelling is not on their agenda. They’re avoiding the common stumbling blocks faced by companies implementing an enterprise architecture tool.

The team takes automation further with AI-generated content that streamlines their productivity.

3. Planning for long-term success with a single source of truth.

Hercules is moving from reactive, short-term decisions to more consistent and controlled change.

“There’s a lot of changes, a lot of growth, our business plan is through integrations so we need to ensure that any company coming in, any change in digital transformation is managed, controlled, and we deliver the best processes and systems.”

With a single source of truth into their processes, services and technology, they can easily plan for the future.

“We have an end to end view of all the changes throughout the business to plan more effectively. With Enterprise Insight, we’re able to identify possible challenges, and deliver more coordinated change long-term.”

4. Communicating change across teams

With all the changes happening at a fast pace, coordinated change is key to seamless service delivery.

Professionals working in digital will understand that communicating new technologies is not just about technology. It’s about adjusting how people work.

And people don’t like change.

Communication is therefore crucial to success.

For teams who don’t understand the complexity of integrations, a technical document or spreadsheet is a hard sell. What’s needed is a clear narrative, backed by data and easy-to-consume visual information.

A major challenge in digital transformation is managing the expectations of teams regarding new technologies.

“People might want something, but when you go through the end-to-end process and how that’s going to knock things down the road, it makes them rethink and address things in a different way from system or process.”

“Enterprise Insight gives you that visibility,” Ed says,

With a multitude of visualisations – be it a dashboard, diagram, or data-driven model – the team is able to tell a story that resonates across the business.

See how we use Publications to share views, embeddable in Confluence and SharePoint.

TLDR;

By gaining visibility into their processes, systems, and services, the digital team at Hercules PLC has achieved strategic transformation during a time of unparalleled growth and complex change – supported by Enterprise Insight.

Getting set up in Enterprise Insight is easy.

Go on. See what all the fuss is about.